| StockFetcher Forums · General Discussion · XIV | << 1 ... 4 5 6 7 8 ... 22 >>Post Follow-up |

| sandjco 648 posts msg #140946 - Ignore sandjco |

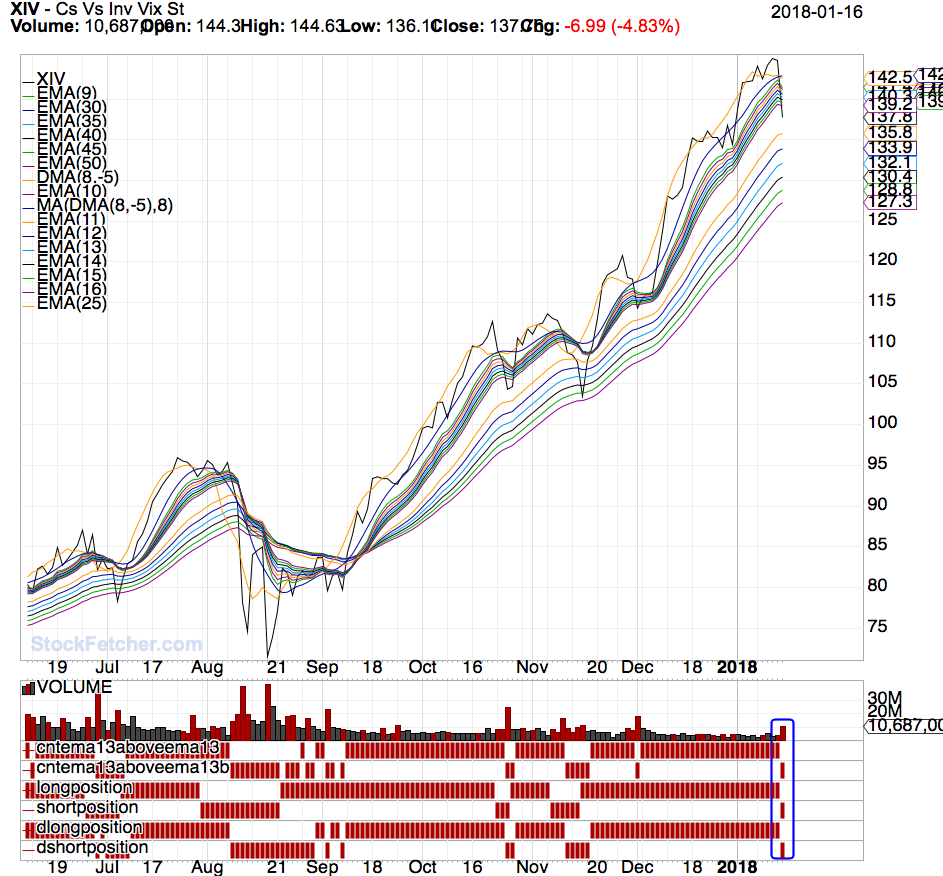

1/13/2018 11:54:24 AM Thank you for sharing everyone! RE: change in trend - I've always liked Mac's usage of his EMA's. I've used this version and l use the 200 EMA as the change in trend. Also use ADX to make sure I only filter stocks with a strong trend (up or down) - I've posted my rookie variation below. - I use Fib #'s for my EMAs |

| Mactheriverrat 3,175 posts msg #140952 - Ignore Mactheriverrat |

1/13/2018 3:30:21 PM @nibor100 K of G's 30 filter XIV SS based system will work for sometime to come if it work for people using it. My point SS which has been discontinued and at some point one day it may or will not work leaving people hanging. Just saying! |

| nibor100 1,099 posts msg #140953 - Ignore nibor100 |

1/13/2018 3:45:32 PM @Mactheriverrat, Oh, you were referring to the SS sw not the K of G system, I'm with you now. Since the SS sw is resident on our computers it should keep running using the same operating system for years to come with no issues. Of course if SS still has some flaws that we later discover we won't be able to get them fixed, but it sure has a lot of capability for free and I suspect many of the kinks are already worked out of it as K of G first reported on using SS back in Jul 2010, so its been working for quite a while now. Thanks, Ed S. |

| Mactheriverrat 3,175 posts msg #140955 - Ignore Mactheriverrat |

1/13/2018 3:56:00 PM I've changed the trigger of a cross of price above the ema(16) or price below the ema(16) . To me with XIV when she makes a correction (like a guppy bubble ) a lot of other traders are doing the same thing. Submit |

| Cheese 1,374 posts msg #140973 - Ignore Cheese |

1/14/2018 10:33:22 AM Thank you, Mac. The Guppy Traders mMAs group is like a first alert since it is so visual. I think alf44 was also a big proponent of mMAs and he once likened mMAs to a set of safety nets. If price falls through a set of safety nets, then the fall would likely be serious. Before any crossings even occurred, Dave's Ira Epstein trading rules are really useful in handling oversbought ovesold condiions, and offer valuable insights on positive negative biases. The embedded SloStoch concept is new to me and also most interesting. Thank you all. |

| Mactheriverrat 3,175 posts msg #141064 - Ignore Mactheriverrat |

1/17/2018 12:25:12 AM Government can't get their act together as shutdown looms. XIV set to take a dump.  Submit Submit |

| davesaint86 726 posts msg #141067 - Ignore davesaint86 |

1/17/2018 8:07:51 AM Cool Mach - The best of both worlds! |

| Mactheriverrat 3,175 posts msg #141091 - Ignore Mactheriverrat |

1/17/2018 2:34:37 PM Nice bounce up today but I would be cautious as government shutdown hangs still. |

| novacane32000 331 posts msg #141098 - Ignore novacane32000 |

1/17/2018 7:19:24 PM Hey Davesaint86 Maybe I’m not understanding how your 1st filter in this thread works. I did a backtest on DUST from 2/2/15 to present and it almost seems too good to be true . 47 wins 5 losses with the avr win being 50% and the avr loss around 4%. That cant be right !! Not sure what I did wrong as far as entering and exiting the trade. I simply bought and sold when the filter toggled from longposition to shortposition. What am I missing here ?? |

| shillllihs 6,101 posts msg #141099 - Ignore shillllihs modified |

1/17/2018 7:46:34 PM I think it is too good to be true. Yesterday was Xiv's first short day, now there are 3 short days. maybe I'm not understanding this completely. How are days changing days later and this would defiantly give some erroneous signals. Unless your signal comes from elsewhere. Sorry if you've answered this already. I was thinking I could retire to some exotic island, or own it with this system. |

| StockFetcher Forums · General Discussion · XIV | << 1 ... 4 5 6 7 8 ... 22 >>Post Follow-up |