| StockFetcher Forums · Stock Picks and Trading · Follow The Money (Options) | << 1 ... 19 20 21 22 23 ... 31 >>Post Follow-up |

| four 5,087 posts msg #141631 - Ignore four |

1/31/2018 1:58:31 PM https://www.forbes.com/sites/greatspeculations/2018/01/30/call-buyers-hit-a-winner-with-extreme-networks-stock/#381313b87aae Shares of network infrastructure equipment maker Extreme Networks just touched a 16-year high on news the stock will be added to the S&P SmallCap 600 Index. At the time of this writing, EXTR is trading up 9.1% at $15.01, bringing its 12-month advance to 172%. In fact, the shares have closed eight straight quarters in positive territory. Call buyers have been enjoying the run, too. |

| 15minofPham 170 posts msg #141636 - Ignore 15minofPham |

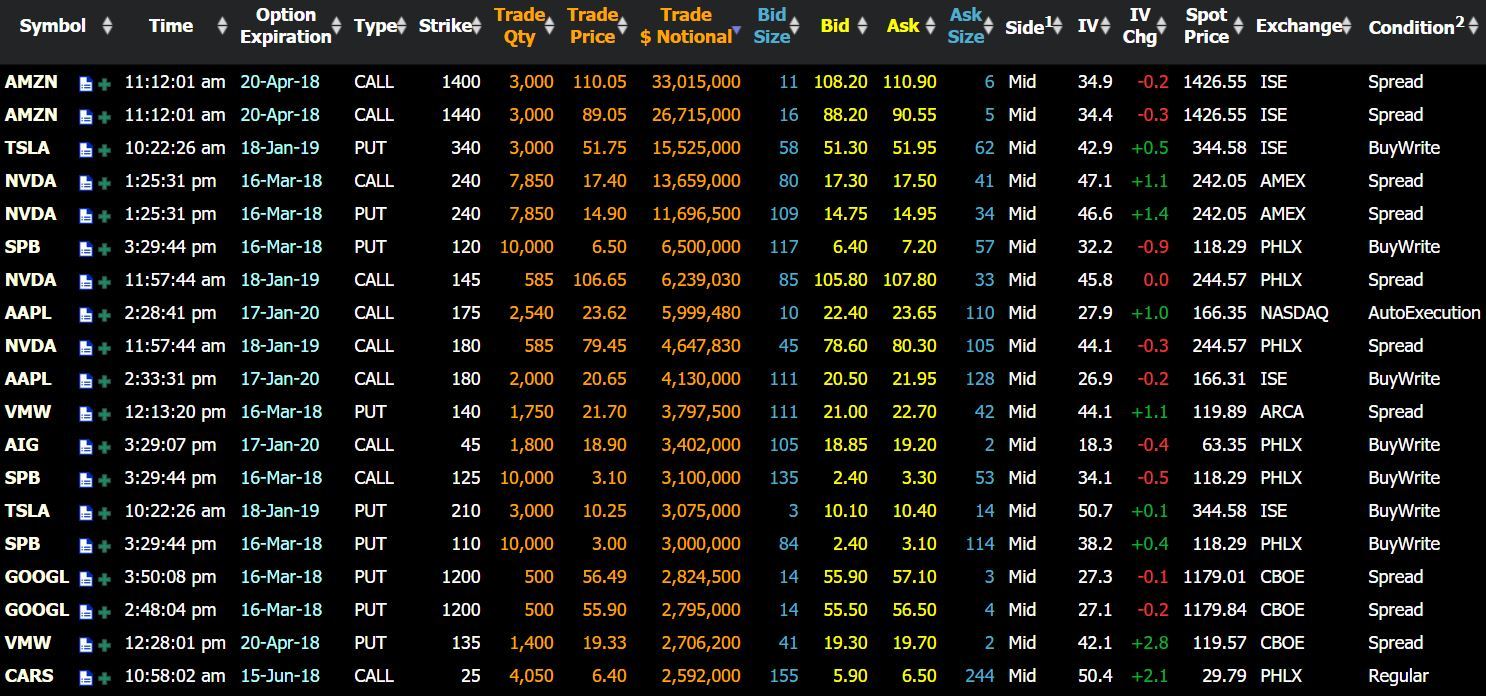

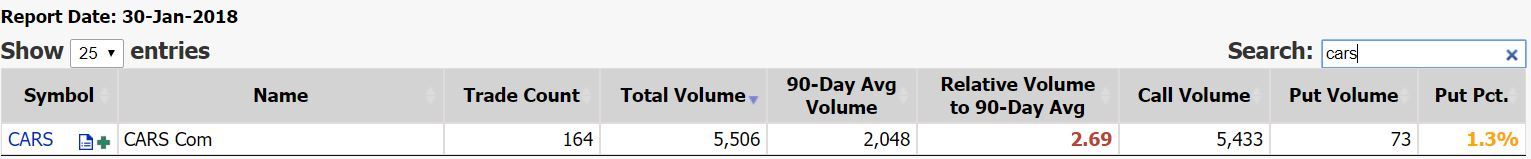

1/31/2018 4:26:13 PM Bo, Lava is correct. I cheated and used Mid instead of Ask & Above. Many times big boys try to hide their plays by buying near the high like CARS. Notice its $6.40 purchase price is closer to the Ask $6.50. This means the Call was bought instead of sold.

Sandjo, The TOTAL Call/Put option volume is FREE. Go to "OPTIONS" at the top of the menu, then choose "OPTION VOLUMES", then type the symbol into the "SEARCH" box.

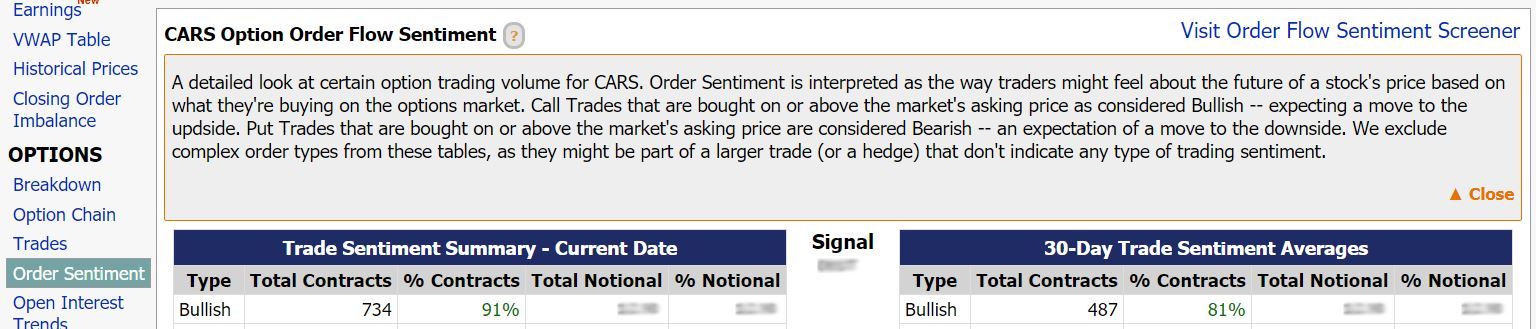

Order Sentiment can be found under "OPTIONS" menu on the LEFT hand side.

The reason why I didn't choose SGMS yesterday was its March expiration was too close to its earnings around end of February to beginning of March. If you're wrong, your option premium will be eviscerated with very little time to recover. HTH |

| BoCap 18 posts msg #141637 - Ignore BoCap modified |

1/31/2018 4:48:20 PM @Lavapit Ahhh, i got it.. Thanks @TuanP , i think im starting to get a hang of it now.. lets look at the chart you posted.. SPB: there are 3 plays , each at 10,000 QTY, so that is most likely it's an Iron condor spread , and that someone is betting the stock will stay within range ? for AAPL: it's a bought call for VMW: 12:28pm 135 PUT, someone sold that put since it's closer to the BID price, Am I correct on those ? |

| 15minofPham 170 posts msg #141640 - Ignore 15minofPham |

1/31/2018 5:32:38 PM Bo, I'm thinking you're right on SPB & AAPL. Harder to tell on VMW unless you click on the "TRADES" page to see the times. Since this was yesterday's trades, I no longer have access since I'm not a member. Great job on understanding this better now! |

| sumit.gargs@gmail.com 7 posts msg #141648 - Ignore sumit.gargs@gmail.com |

1/31/2018 7:44:13 PM I have few queries around marketchameleon: 1. I understand looking at "Common" in the "Stock Type" dropdown. Why not ETFs? Does buying of big blocks of call and put in ETFs does give a clear picture? 2. My understanding is that we should look at "AutoExecution", "Regular" and "StoppedIM" conditions only. Am I correct? What do these conditions mean? Is there any other condition that we should look at? |

| sumit.gargs@gmail.com 7 posts msg #141649 - Ignore sumit.gargs@gmail.com |

1/31/2018 7:49:14 PM One more query. Is there any way I can look at big block options trading for a stock over last few days/weeks? For example, I want to see what the smart money has been doing in AAPL for last 15 days so that I can get a clearer picture of where they think the stock is going? |

| 15minofPham 170 posts msg #141655 - Ignore 15minofPham |

1/31/2018 9:58:45 PM sumit.gargs@gmail.com 4 posts msg #141648 - Remove message 1/31/2018 7:44:13 PM I have few queries around marketchameleon: 1. I understand looking at "Common" in the "Stock Type" dropdown. Why not ETFs? Does buying of big blocks of call and put in ETFs does give a clear picture? The majority of ETF block buys are spread. It certainly can give you an idea what sectors the big players are rotating their money in. Then you can check to see what companies have the most weight in that ETF or just play the ETF outright. 2. My understanding is that we should look at "AutoExecution", "Regular" and "StoppedIM" conditions only. Am I correct? What do these conditions mean? Is there any other condition that we should look at? These are OPRA codes. MC lists them on their page. sumit.gargs@gmail.com 4 posts msg #141649 - Remove message 1/31/2018 7:49:14 PM One more query. Is there any way I can look at big block options trading for a stock over last few days/weeks? For example, I want to see what the smart money has been doing in AAPL for last 15 days so that I can get a clearer picture of where they think the stock is going? This requires a membership. |

| Cheese 1,374 posts msg #141656 - Ignore Cheese |

1/31/2018 10:15:16 PM Does anybody know how we can use the BLOCK TRADE information from @scanzalerts tweets ? Thanks. BLOCK TRADE: $QQQ 500,000 shares @ $168.96 [15:33:39] BLOCK TRADE: $QQQ 500,000 shares @ $169.29 [11:38:45] BLOCK TRADE: $SPY 1,500,000 shares @ $282.27 [12:33:10] |

| BoCap 18 posts msg #141659 - Ignore BoCap |

2/1/2018 12:12:55 AM To all experts: how would you explain the sentimental of an order buy at ASK price, or BID or Mid ? |

| 15minofPham 170 posts msg #141660 - Ignore 15minofPham |

2/1/2018 12:14:40 AM Follow the Money Play of the Day - SQ Premium of $4.5 million on 4,787 of the 3/16/18 $38 Call for $9.50 with stock at $46.52. Daily chart shows attempting to retest $49.50 high. Earnings is on 2/21 and today's buy might be a sympathy play on PYPL earnings even though PYPL is down 11% after hours. This might affect SQ and if so one can get into a lower price. Break even of $47.50 is only 1.26% above today's closing price of $46.91. Total option volume Call/Put ratio was 75-25 and bullish order sentiment was 75%, slightly lower than its 30-day average of 78%. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ Tuesday's spotlight - CARS, $2.6 million, 4.500, 6/15/18 $25 Call $6.40, Stock $29.79 Gained a negligible .03% which saw the option premium go back to the purchase price. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ RIG, MLCO & AMZN are nearing the first profit target of 50%. The latter reports earnings after tomorrow's bell so I'll close out the position so not to risk a beating. VMC was a big loser today as it dropped 3.17% which dropped its Call 26%, a little more than half way to our 50% stop loss.  |

| StockFetcher Forums · Stock Picks and Trading · Follow The Money (Options) | << 1 ... 19 20 21 22 23 ... 31 >>Post Follow-up |