| StockFetcher Forums · Stock Picks and Trading · Follow The Money (Options) | << 1 ... 20 21 22 23 24 ... 31 >>Post Follow-up |

| karennma 8,057 posts msg #141661 - Ignore karennma |

2/1/2018 7:17:55 AM @ 15minofPham Re: "AMZN are nearing the first profit target of 50%. The latter reports earnings after tomorrow's bell so I'll close out the position so not to risk a beating." ======================= Since you're options trading, why did you opt to not buy puts .. or sell calls? |

| karennma 8,057 posts msg #141662 - Ignore karennma |

2/1/2018 7:23:03 AM @ 15minofPham, BTW, not berating you for doing that. I would've done the same. |

| 15minofPham 170 posts msg #141671 - Ignore 15minofPham |

2/1/2018 10:11:46 AM Market is still weak, so selling AMZN 3/16/18 Call at $73 for a 26% gain. It reports earnings after the bell today. |

| 15minofPham 170 posts msg #141672 - Ignore 15minofPham |

2/1/2018 10:14:13 AM Karen, Good question. This thread is not really a stock picks per se, but instead follow the smart money. It's an experiment to see how well/bad one does if you only follow the big option purchases. HTH |

| karennma 8,057 posts msg #141678 - Ignore karennma |

2/1/2018 10:46:58 AM I understand and appreciate your posts. We've never really had a good thread here for options. Thanks. 👍🏻 |

| 15minofPham 170 posts msg #141723 - Ignore 15minofPham |

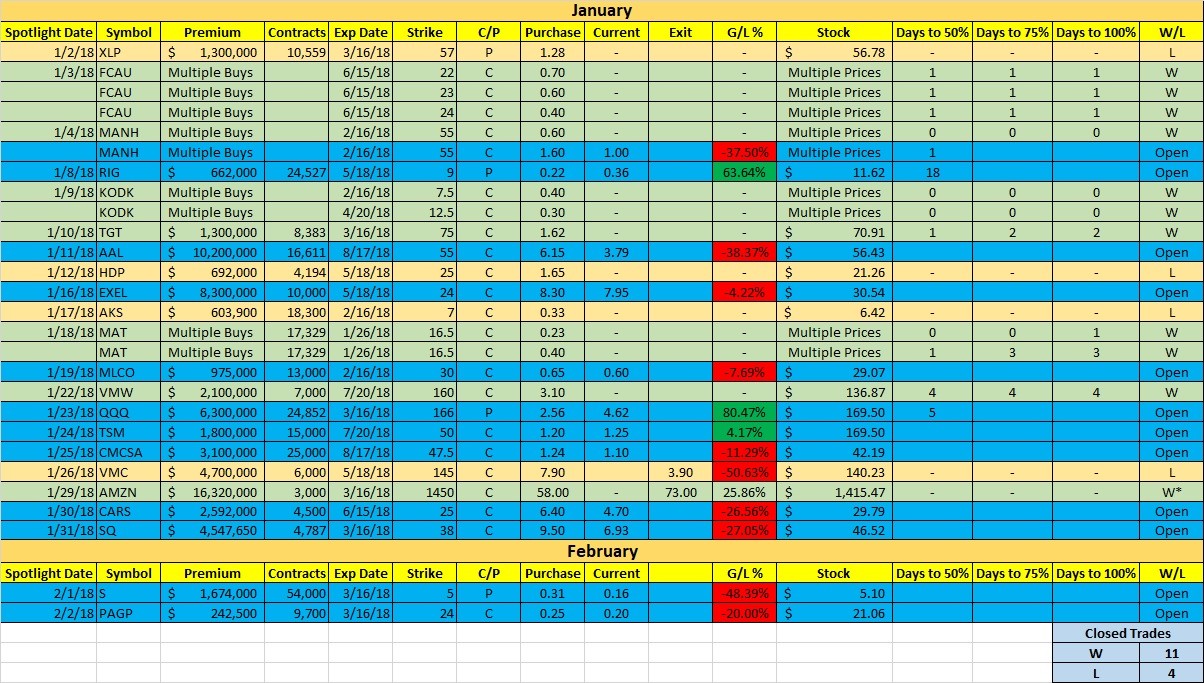

2/1/2018 11:15:37 PM Follow the Money Play of the Day - Sprint (S) Premium of $1.6 million on 54,000 of the 3/16/18 $5 Put for $0.31 with stock at $5.10. This is a pure earnings play as it reports tomorrow morning. Sprint has been a beaten down stock for a year and this investor thinks it will remain for the time being. Total option volume Call/Put ratio was 17-83 and bullish order sentiment was 57%, lower than its 30-day average of 68%. Change in picking methodology: Many times I'll see multiple lots adding up to be larger than just one big buy. If this is the case, I'll go with the former since multiple investors usually out trump one or two. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ Wednesday's spotlight - SQ, $4.5 million, 4,787, 3/16/18 $38 Call $9.50, Stock $46.52 As expected, Paypal's down day also affected SQ as it dropped 3.31% which in turn dropped the option to -22%. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ Sold AMZN for 25% since it reported earnings after the bell. The option was punished after I sold it, but it looks like it might recover since it's up 6.27% after hours. I put an asterisk by the W to indicate the sell was before the 50% target. Another choppy day hurt the portfolio. You're seeing first hand how tough it is to make money in options when the market is choppy. It frustrates both bulls & bears. This is a great time to remind everyone again to buy options far out to give you time to recover when the market is not trending.  |

| BoCap 18 posts msg #141726 - Ignore BoCap modified |

2/2/2018 12:43:52 AM Also how do i post Screen Shots ? |

| 15minofPham 170 posts msg #141795 - Ignore 15minofPham |

2/2/2018 11:28:04 PM Follow the Money Play of the Day - PAGP It was a tough decision between PAGP & WMT. The former "big" play pales in comparison in premium with the latter, but its relative volume was just too high to ignore. Premium of $242K on 9,700 of the 3/16/18 $24 Call for $0.25 with stock at $21.06. It's been beaten down this past week as with everyone else due to the violent pullback in the market. However, its total option volume today was 12.67 times its 90-day avg. Break even of $24.25 is nearly 18% from its closing price of $20.56. This would put it above its 52-week intraday high of $24.09. Total option volume Call/Put ratio was 100-0 and bullish order sentiment was 100%, easily above its 30-day average of 68%. Its total Puts volume today was only 8! If this doesn't indicate to you that it's not going anywhere but higher from here than I don't know how else to explain this to you. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ Thursday's spotlight - S, $1.6 million, 54,000, 3/16/18 $5 Put $0.31, Stock $5.10 A rare occurrence today where the Put didn't pan out. S gained 5.10% after earnings which in turn cratered the Put premium to -48%, almost at the stop loss -50%. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ The portfolio saw its fourth loss as VMC hit the 50% stop loss. Even though the expiration is still three months away, for tracking uniformity, rule states it must be sold at -50%. A huge error in not selling MLCO yesterday when it hit +50% came back to bite me hard. It dropped 4.09% eviscerating the gains to now a loss of -7.69% This is a great example to take PROFITS in a very weak tape. I had a hard time believing the QQQ $6.3 million hedge play on 1/23. After all, the market was humming along to yet another 52 week high. But as I mentioned in that post, you simply can't ignore this big of a hedge play. Somebody ALWAYS knows! The profit stands at 80% and a weak opening on Monday should easily help it to the automatic sell target of 100%. RIG 5/18/18 9 Put took 18 trading days to hit +50%, by far the longest, but it still has room to fall. However, there's only 17K in OI so the investor has sold some of his 24K contracts. I will sell if there's any market bounce. Might make it to +75%, but 100% looks difficult as its daily Stochs is below 9. DISCLAIMER: This is a paper trading portfolio. It is an experiment in detailing following of "smart" money.  |

| 15minofPham 170 posts msg #141867 - Ignore 15minofPham |

2/5/2018 9:42:19 AM Both QQQ & RIG Puts hit the auto 100% gain sell target. |

| Daniel Kotas 2 posts msg #141889 - Ignore Daniel Kotas |

2/5/2018 3:37:24 PM Hello guys, looking at SQ options with expiry on 2/16/18 and 3/16/18, the strikes 42 and 42,50 have really high OI, but on BOTH call and put side. Any idea what that might mean? I have a SQ C2/16/18 @3.75 just for the record. Thank you for response! |

| StockFetcher Forums · Stock Picks and Trading · Follow The Money (Options) | << 1 ... 20 21 22 23 24 ... 31 >>Post Follow-up |